– Vietnam’s digital door lock market is expected to grow due to the continued growth of the construction industry and the increase in Vietnam’s median-income households –

– It will be advantageous to target a wide range of consumers by launching various products from low-priced to high-priced products –

Steady growth in Vietnam’s construction sector

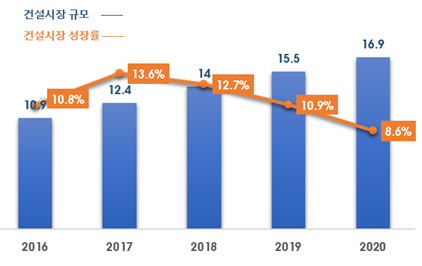

Before examining Vietnam’s digital door lock market, it is necessary to look at the prospects of Vietnam’s construction sector. This is because the construction market and the building materials market are proportional. In 2020 alone, Vietnam’s construction industry recorded a year-on-year growth of 8.6%.

Changes in Vietnam’s construction market size and growth rate (2016-2020)

(Unit: US$ billion, %)

Source: Vietnam National Statistical Office

According to Savills, about 25,800 new homes are expected to be added to Hanoi in 2021. Of these, 89% are Grade B apartments, priced between $1,000 and $1,500 per square meter. In the case of Ho Chi Minh City, about 18,000 new households are expected to be newly supplied in 2021, and among them, the supply rate of high-end and B-grade apartments is expected to increase by 9% compared to the previous year. Residential-commercial apartments are appearing one after another in Vietnam, centered on large cities, and they value stylish interiors, convenience and security, so it is expected that the demand for mid/high-end and high-end mid/small-sized apartments will increase, especially among young Vietnamese with economic power. do.

As such, the construction industry is relatively unaffected by COVID-19 compared to other sectors, and as Vietnam’s construction industry is promising, the building materials and interior markets are expected to continue to grow.

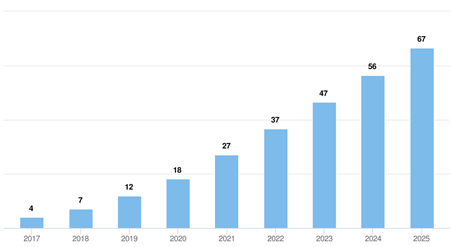

Size of the home security market in Vietnam

As of 2019, digital door locks accounted for only 3% of the Vietnamese door lock market. Detailed statistics on the digital door lock market are not yet available, but Statista predicts that Vietnam’s home security market will grow at an average annual rate of 30.07% over the five-year period from 2020 to 2025.

Smart Home Security Market Size in Vietnam (2017-2025)

(Unit: US$ million)

Source: Statista (2021.5)

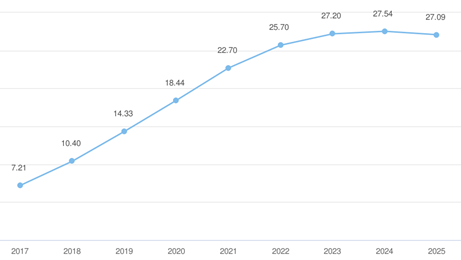

Average smart home installation cost per household (2017-2025)

(Unit: US$)

Source: Statista (2021.5)

The smart home security system includes digital door locks, CCTV security devices, network devices, unmanned controllers, risk detection devices, and smart home unmanned security services (ADT, S1, etc.). The smart home security market is expected to evolve from traditional security methods and continue to grow in line with the demands of modern people who seek more convenient and safe security methods.

Although Vietnam’s home security market is still in its introductory stage, it is expected to grow to account for 15.5% of the Southeast Asian market by 2025. The excellent technology affinity of the Vietnamese MZ generation can also be a factor that helps expand the home security market in Vietnam. The MZ generation is accustomed to using various smart products and media such as smartphones and smart pads and using smartphone apps. As the number of middle-income households increases in Vietnam and their purchasing power improves, consumption of home security equipment is expected to increase naturally.

In addition, since Vietnam has a high ratio of working age people in their 30s and 40s working both jobs, security equipment is needed to prepare for safety risks that occur while grandparents are at home taking care of their children. This increase in economically active population can be a factor that increases the demand for digital home security equipment.

Digital door lock market trend in Vietnam

Types of digital door locks

In Vietnam, the common key lock method still accounts for the largest portion of the door lock market. In the case of digital door locks, there are mixed methods of card key, fingerprint recognition, and key lock depending on the difference in opening and closing methods.

Digital door locks include an electro magnetic lock, a fingerprint access lock, and a password-protected lock. (Smart Lock) method is also available. Padlock-type digital locks first appeared in the Vietnamese market because they are more economical and easier to use than other digital locks. Among the companies that produce digital locks, companies with high recognition in the Vietnamese market include Viet Tiep (Vietnam), Huy Hoang (Vietnam), Abus (Germany), Yeti (Italy), and Yale (Sweden). As the supply of new apartments increases, there are cases in which newly built apartments adopt smart digital door locks and smart home systems at the same time. Connecting the existing analog lighting, home appliances, and door opening and closing operations with a digital system is costly for parts replacement and new installation, so rather than remodeling and upgrading with a smart home system, smart More often than not, the home method is adopted. In the case of a digital door lock, it is easy to use independently even if it is not linked to the entire smart home security system, so it is likely to grow independently without being greatly affected by the growth of the smart home market.

The target consumers for digital door locks in Vietnam are tech-savvy young middle-class households living in apartments. They mainly work both incomes and live busy lives, so they may prefer a convenient and safe digital door lock.

There are two main types of digital door locks. It is a digital door lock with biometric recognition such as fingerprint, iris, voice, and vein recognition, and a mechanical recognition digital door lock that uses a password, smart key, and smart card. Products with various mixed security functions and IoT functions are expensive, but Vietnamese consumers are price sensitive, so they prefer practical digital door locks rather than expensive digital door locks.

Vietnamese local companies such as Viet Tiep and Appota have created R&D departments to survive in the digital door lock market, which is dominated by overseas products such as Hafele and Samsung, and are targeting the low-end market with competitive prices and practical features compared to imported products.

income trend

HS Code 830140 includes both digital door locks with handles and digital door locks without handles. Door locks imported to Vietnam in 2020 totaled $9.6542 billion. Among them, China is the number one importer, importing $8.7713 billion, accounting for 90.86% of the total. South Korea imported $282.6 million, followed by door lock imports from the Philippines, Taiwan, Japan, and Thailand, but the share of these countries is very low, from 1.38% to less than 1%. In particular, in 2020, it can be seen that door lock imports have decreased in most countries due to the impact of Corona 19. Among the top 10 importing countries, Taiwan, France and Canada were the only countries with an increase in import volume in 2020 compared to 2019.